how to find contribution margin

What is the Contribution Margin?

The contribution margin is a measurement through which we understand how much a company's net sales will contribute to the fixed expenses and the net profit after covering the variable expenses. So, while calculating the contribution, we deduct the total variable expenses from the net sales.

Contribution Margin Formula

To calculate this ratio, all we need to look at are the net sales and the total variable expenses. Here's the formula –

Contribution Margin = Net Sales – Total Variable Expenses

You are free to use this image on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Contribution Margin (wallstreetmojo.com)

It can be expressed in another way as well.

Contribution Margin = Fixed Expenses – Net Income

In situations, where there's no way we can know the net sales, we can use the above formula to find out the contribution.

Example

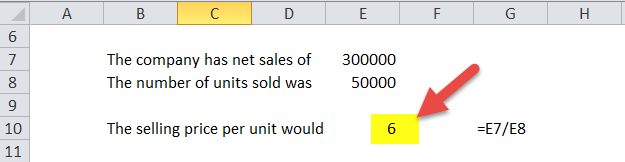

Good Company has net sales of $300,000. It has sold 50,000 units of its products. The variable cost of each unit is $2 per unit. Find out the contribution, contribution margin per unit, and contribution ratio.

- The company has net sales of $300,000.

- The number of units sold was 50,000 units.

- Selling price per unit would be = ($300,000 / 50,000) = $6 per unit.

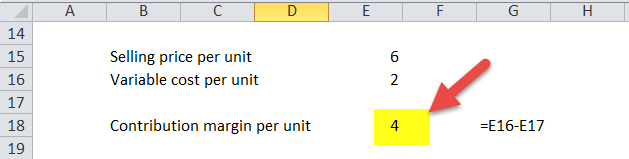

- The variable cost per unit is $2 per unit.

- Contribution margin per unit formula would be = (Selling price per unit – Variable cost per unit Variable cost per unit refers to the cost of production of each unit produced, which changes when the output volume or the activity level changes. These are not committed costs as they occur only if there is production in the company. read more ) = ($6 – $2) = $4 per unit.

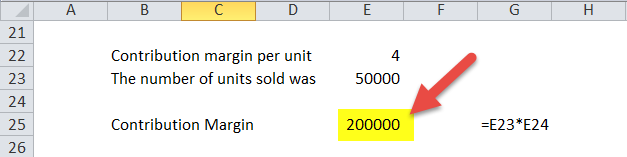

- Contribution would be = ($4 * 50,000) = $200,000.

- Contribution ratio would be = Contribution / Sales = $200,000 / $300,000 = 2/3 = 66.67%.

In this example, if we would have been given the fixed expenses, we could also be able to find out the net profit of the firm.

Uses

You may ask why we need contribution. We need a contribution to find out the break-even point Break-even analysis refers to the identifying of the point where the revenue of the company starts exceeding its total cost i.e., the point when the project or company under consideration will start generating the profits by the way of studying the relationship between the revenue of the company, its fixed cost, and the variable cost. read more .

We will look at how contribution becomes useful in finding out the break-even point.

Let's say that a firm's fixed expenses are $100,000. The variable cost of the firm is $30,000. We need to find out the break-even point.

By using the concept of contribution, we will find out the break-even point.

Contribution Margin = Net Sales – Variable Cost = Fixed Cost + Net Profit

Here, we can write –

Net Sales – Variable Cost = Fixed Cost + Net Profit

At the break-even point, the key assumption is that there will be no profit or no loss.

Then,

- Net Sales – Variable Cost = Fixed Cost + 0

- Or. Net Sales Net sales is the revenue earned by a company from the sale of its goods or services, and it is calculated by deducting returns, allowances, and other discounts from the company's gross sales. read more – $30,000 = $100,000

- Or, Net Sales = $100,000 + $30,000 = $130,000.

That means $130,000 of net sales, the firm would be able to reach the break-even point.

Contribution Margin Calculator

You can use the following Calculator

| Net Sales | |

| Total Variable Expenses | |

| Contribution Margin Formula | |

| Contribution Margin Formula = | Net Sales – Total Variable Expenses |

| 0 – 0 = | 0 |

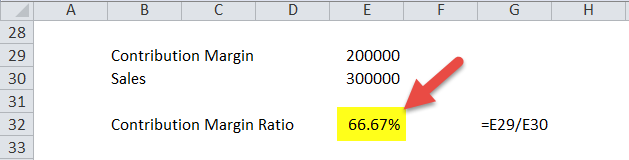

Calculate Contribution Margin in Excel (with excel template)

You can easily calculate the ratio in the template provided.

The contribution margin ratio per unit formula would be = (Selling price per unit – Variable cost per unit)

The contribution would be = (Margin per Unit * Number of Units Sold)

The contribution ratio would be = margin / Sales

You can download this template here – Contribution Margin Ratio Excel Template

Contribution Margin Video

Recommended Articles

This has been a guide to the Contribution Margin and its meaning. Here we discuss the formula to calculate Contribution Margin along with practical examples and excel templates. You may also look at the following articles to enhance your financial skills.

- Ratio Analysis Types

- 401k Contribution Calculator

- Defined Contribution Plan Example

- Margin Debt Example

- Examples of Gross Margin Formula

how to find contribution margin

Source: https://www.wallstreetmojo.com/contribution-margin/

Posted by: rodriguezplad1987.blogspot.com

0 Response to "how to find contribution margin"

Post a Comment